An Educational Course for Adults Age 65+

Questions? 503-878-8529

Course Outline

Session 1

Section 1: Retirement Income Concerns

- Finding balance in retirement

- How financial rules change at retirement

- Embracing a self–reliant retirement

- Why Americans retire earlier and live longer than expected

- Transferring longevity risk

- Elder fraud prevention

Section 2: How Long Will My Money Last?

- Estimating annual retirement expenses

- Calculating annual withdrawal rates

- The impact of declining markets

- Taxes & inflation

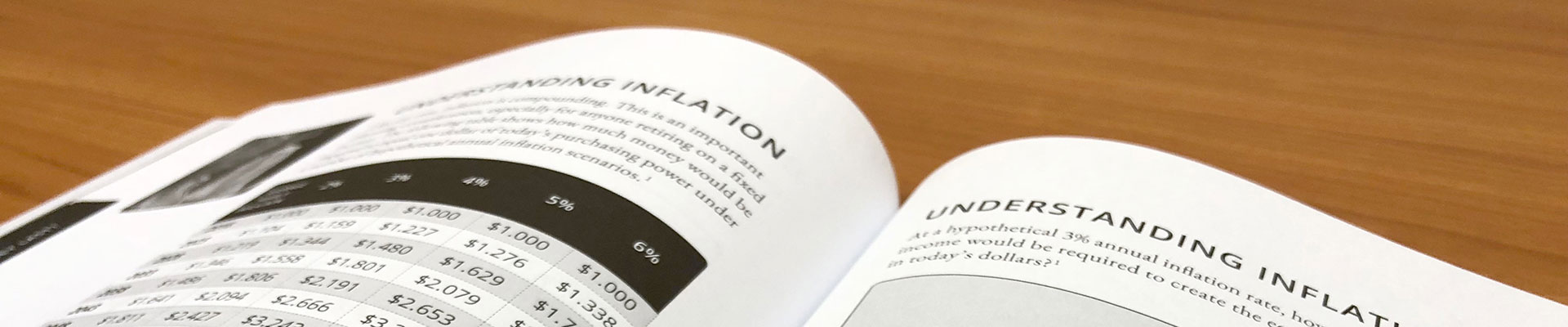

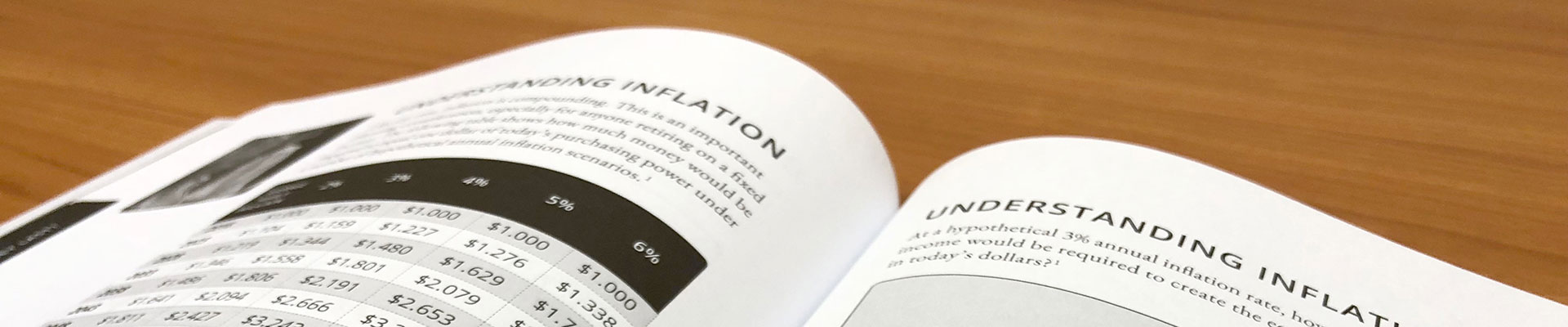

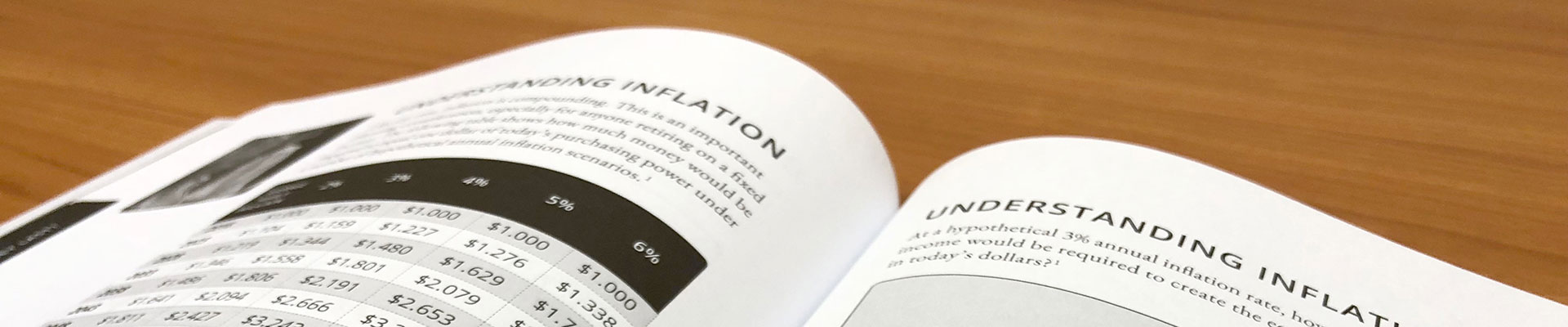

- Understanding inflation

Section 3: Investments

- Feelings vs. behavior

- Investment considerations

- Common investment risks

- Risk management strategies

- Income taxes in 2019

- Tax exempt vs. taxable income

- Cash reserve accounts

- DIY vs. professional money management

- Individually managed accounts

- Mutual, index & exchange–traded funds

- Immediate, deferred, variable, fixed, and indexed annuities

Find Course

Session 2

Section 4: Retirement Income Sources

- Social Security strategies

- Social Security & taxes

- IRAs vs. Roth IRAs

- Required minimum distributions

- Stretch IRAs

- Tax efficiency & withdrawal choices

- IRA to Roth IRA conversions

- 401(k) rollovers

- Pensions: lump sum or payments?

- Annuity withdrawal choices

- Choosing your beneficiary

Section 5: Health Care Planning

- Health insurance & health care costs

- Evaluating the cost of coverage

- Health insurance options in retirement

- Comparing Medicare plans

- Planning for long–term care expenses

- Long–term care insurance

- Legal planning

Section 6: Estate Planning

- Reasons to update your estate plan

- Estate planning & distribution

- The probate process

- Wills, intestacy & trusts

- Comparing different types of trusts

- Life insurance & annuities

- Taxation of estates